About us

Information Disclosure in Line with TCFD Recommendations

Governance

Sustainability Committee

In December 2021, the Company established the Sustainability Committee, which is chaired by the Director and General Manager of the Management Division of the Company. Material issues for achieving Group-wide sustainability, including issues related to climate change, are discussed by the Sustainability Committee and reported to the Board of Directors. The Sustainability Committee has established a system to facilitate responses to climate risks and business opportunities, reports at least once a year to the Board of Directors on climate change issues it discussed, and is subject to oversight by the Board.

Supervisory system of the Board of Directors

The Board of Directors receives reports on climate risks and opportunities from the Sustainability Committee at least once a year, and monitors and oversees the actions taken and goals set by the Committee. Furthermore, regarding material issues, including the corporate strategy, corporate plan, annual budget and earnings targets, the Board of Directors reviews climate risks and opportunities, and takes action accordingly.

Strategy

(a) Details of short-, medium- and long-term risks and opportunities

The Group understands that risks pertaining to environmental issues may have an impact on its business activities over a long period of time, and that therefore, such risks must be reviewed for an appropriate length of time. Looking ahead to the current fiscal year, the three periods from fiscal 2022 to fiscal 2024, and fiscal 2030, the Group examines physical risks, such as extreme weather posed by climate change, policies and regulations to be introduced by governments, and transition risks, such as changes in market needs. Risks and opportunities identified as a result of the review are incorporated into Group strategies and responded to accordingly.

Definition of period for reviewing climate risks and opportunities of the Group

[Period and Definition]

- Short-term: Current fiscal year

- Medium-term: From fiscal 2022 to fiscal 2024 (Three terms)

- Long-term: Until fiscal 2030

(b) Details and the degree to which risks and opportunities may affect the business, strategy and financial plan

The Group performs scenario analysis for the purpose of assessing the risks and opportunities that climate change may pose on the Group as well as their impact, and examining the resilience of the Group’s strategy, which takes into consideration the world in 2030, and the need for further actions.

In reference to several existing scenarios publicized by the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC), we performed scenario analysis that assumes two different scenarios: a case assuming the Paris Agreement target where “global average temperatures will increase no more than 2 degrees Celsius above pre-industrial levels” (“2-Degree (including 1.5-degree) Scenario”); and a case where, on the assumption that no additional measures or regulations are adopted and existing measures and regulations are accomplished, global GHG emissions will exceed the present level (“4-Degree Scenario”).

“Towards a Decarbonized Society”, our materiality theme, we analyze the effects of climate change on the Group’s business activities based on the above scenarios, consider the countermeasures, and review the Group’s strategic resilience.

[Existing scenarios referenced]

- 2-Degree Scenario

Sustainable Development Scenario (SDS) (IEA, 2019, 2020)

Representative Concentration Pathways (RCP2.6) (IPCC, 2014)

SR1.5

- 4-Degree Scenario

Stated Policy Scenario (STEPS) (IEA, 2019, 2020)

Representative Concentration Pathways (RCP6.0, 8.5) (IPCC, 2014)

[Future course of individual scenarios]

World in the 2-Degree Scenario (with strict preventive measures)

- Government: Active commitment, significant tightening of recycling regulations, various subsidies

- Carbon tax: Adopted

- Smart city concept: Storage batteries and EVs become widespread

Shift to environmentally friendly products/services - Energy: Shift to renewable energy, rising electricity prices

Strict management of products that require temperature control

Damage caused by storm surge due to sea level rise (less than the 4-degree scenario) - Strict management of products that require temperature control

Future course of the “4-degree scenario” (without taking any preventive measures)

- Government: No active commitment, no significant tightening of regulations

- Carbon tax: Not adopted

- Smart city concept: Not proceeded with

Shift to environmentally friendly products: Not proceeded with quickly - Energy: Continued dependence on fossil fuels, and delays in promoting the use of renewable energy

Stricter management of products that require temperature control due to extreme heat

Damage caused by storm surge due to sea level rise - Typhoon: Effects on equipment and supply chain due to the intensification of extreme weather (typhoon, torrential rain, etc.)

Possible effects on the Group’s business and finances in 2-Degree Scenario and 4-Degree Scenario in 2030

An outline of the Group’s risks and opportunities, and the associated effects on its business and finances under the two scenarios is as follows. The effects on business and finances are presented qualitatively in three stages (H, M, and L in the list).

Outline of the Group’s risks and opportunities, and the effects on its business and finances

| Item | Classification | Change in business environment | Effects on the Company | Duration | Severity of effects at the time of occurrence | |

|---|---|---|---|---|---|---|

| 2-Degree Scenario |

4-Degree Scenario |

|||||

| Transition risks | Policy and Regulation | Carbon tax adopted | Increased logistics costs | Med- to long-term | M | L |

| Management risks | Strict temperature control | Increased costs for handling products that require temperature control | Short- to med-term | L | M | |

| Reputation | Change in customer behavior | Losing customers due to a delay in adapting to decarbonization | Med- to long-term | M | L | |

| Physical risks | Chronic | Sea level rise and storm surge | Increased investment costs to finance disaster prevention measures | Long-term | L | M |

| Acute | Extreme weather | Effects of typhoons and torrential rain, etc. on logistics | Short- to med-term | M | H | |

| Opportunity | Service | Reputation among suppliers | Climate change initiatives and information disclosure are highly regarded by environmentally-conscious manufacturers | Short- to med-term | - | - |

| Products | Reputation among buyers | The Company is chosen by environmentally-conscious hospitals for its coverage of low-carbon products and awareness-raising activities | Med- to long-term | - | - | |

| Resilience | Reputation among suppliers and buyers | Reputation among business partners for our stable supply at the time of wind- and water-related disasters | Med-term | - | - | |

(c) Risks and opportunities, and effects on finances based on related scenarios, and strategy for and resilience to them

Whether in the 2-Degree Scenario or in the 4-Degree Scenario, we will strive to achieve strong strategic resilience from a medium- to long-term perspective. To that end, we will strive to secure another opportunity for growth through formulating an appropriate measure to avoid (negative) risks in business strategies and the medium-term management plan, while proactively responding to changes in the market in gaining positive opportunities

Relocation of the Kanto region business site to avoid water-related disasters

We relocated the aging Kanto region business site in August 2022. According to the Taito-ku hazard map, the previous location corresponded to an area with a flood depth of 0.5 m to less than 3.0 m when the Arakawa River overflows, but the new relocation site (Otsuka 5-chome, Bunkyo-ku) is outside the inundation area. With solar panels installed on the rooftop, we strive to reduce environmental burden as part of our ESG management.

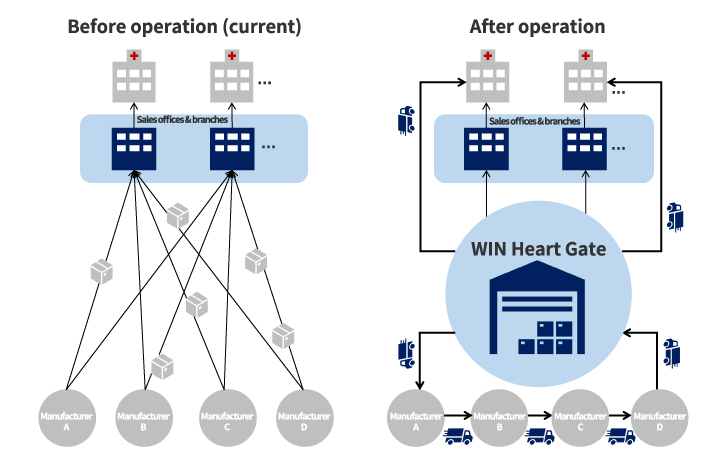

Realize efficient supply chain and secure resilience by operating WIN Heart Gate

Construction of WIN Heart Gate, our new logistics center, was completed in November 2022 near the Tokyo International Airport. In the future, WIN Heart Gate will cover nine sales sites in the metropolitan area and streamline logistics, aiming to serve as the core facility of our Logistics Revolution.

Located near the logistics site of major manufacturers of medical devices, WIN Heart Gate will change existing logistics of medical devices. Specifically, medical devices, which have been delivered from each manufacturer’s logistics site to individual sales sites, will be collected by the Group using the Milk Run method and delivered directly to medical institutions from WIN Heart Gate. This can reduce shipping costs and enhance the efficiency of product delivery. Products will be stored on the second floor or higher of the building to minimize damage in the event of a flood.

With solar panels installed on the rooftop, we will strive to reduce environmental burden as part of our ESG management. In addition, we are concurrently developing a new core system and a sales and inventory control system, which will enter an experimental stage in early 2023 and commence operation in around February 2024. Through these efforts, we will strive to expand our business and improve profitability.

WIN Heart Gate

Risk management

(a) Detailed process for identifying and evaluating climate risks, and a method for determining materiality

Risks pertaining to environmental issues are reported to the Sustainability Committee of the Group. The Sustainability Committee examines risks pertaining to environmental issues (including climate risks) in detail to identify material risks and opportunities.

(b) Detailed process for managing material climate risks, and a method for prioritizing them

Through the process above, climate risks and opportunities evaluated as material are defined as one of our corporate risks and incorporated in the Group strategy under the supervision of the Board of Directors.

(c) Status of integration into the company-wide risk management framework/p>

In line with the risk management policy, the Administration Dept. of the Group continually collects information related to speculative risks faced by companies (risks that may lead to both loss and/or profit) from individual departments, and reports such information to the Management Meeting and the Board of Directors. Among such information, that related to risks pertaining to environmental issues (including climate risks and opportunities) is also reported to and shared with the Sustainability Committee for identification, assessment, and management as stated above.

Metrics and targets

(a) Metrics used to manage climate-related risks and opportunities

The Group has identified three indicators for managing climate-related risks and opportunities: Scope 1, 2, and 3 greenhouse gas (GHG) emissions, Scope 1, 2, and 3 GHG emissions per unit of sales, and ratio of renewable energy in electricity used in our business activities.

(b) GHG emissions (Scope 1, 2, and 3)

The Group-wide Scope 1, 2, and 3 GHG emissions and GHG emissions per unit of sales for FY2022 are shown below.Please see the data sheet for details.

| GHG emissions | GHG emissions per unit of sales | |

| Scope1: | 1,182t-CO2 | 1.7t-CO2/100 millions yen |

| Scope2: | 529t-CO2 | 0.8t-CO2/100 millions yen |

| Scope3: | 162,812t-CO2 | 229.8t-CO2/100 millions yen |

Please see the third-party verification opinion for the Group’s GHG emissions calculation.

(c) Targets used to manage climate risks and opportunities, and actual results

Towards the achievement of the 2-Degree Global Scenario, our long-term GHG emission reduction targets are to reduce Scope 1 and 2 GHG emissions per unit of sales by 50% by FY2030 compared to FY2021 (base year), and to reduce Scope 3 GHG emissions per unit of sales by 30% by FY2030 compared to FY2021 (base year).

In addition, we aim to achieve a 50% share of renewable energy in the electricity used in our business activities by FY2030.

We are planning to bring logistics operations (cargo collection and delivery) in-house through the “logistics revolution”, so we plan to re-set the metrics and targets after the completion of the initiatives.